The outlook on finance for homeowners in 2024 appears significant in anticipation for the RBA to initiate a reduction in the official cash rate.

According to the consensus among the major four banks, it is expected that interest rates will likely remain steady throughout most of 2024. However we should not expect a rate cut until at least somewhere between August and December.

Economists anticipate that the next rate cut is not likely to occur until between August and December, 2024.

As the RBA convenes in February 2024, it is likely that they will maintain current interest rates. Throughout the first half of the year, interest rates are expected to stabilise the economy, although there remains a chance of one more increase if inflation proves challenging to control.

The RBA’s decisions in 2024 will carry greater weight on the broader economy, particularly as approximately 450,000 mortgage holders transition from low fixed rates to higher variable rates. Projections suggest that rates may not decrease to 2.85% until at least May or June 2025.

Despite interest rate hikes, the property market has exhibited resilience with first time homebuyers and investors undeterred. To accommodate the rate increases, these homeowners have mainly reevaluated their budgets.

Why do property prices increase in a high interest rate market?

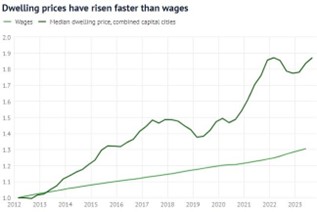

Many people commonly attribute price increases to population growth, however another significant factor is the growing trend of property buyers who have relied on wealth accumulated within the property market (rather than income from wages), be it their own or inherited from parents or grandparents.

The impact of the ‘Bank of Mum and Dad’ is hard to measure, yet its influence is noted on auction floors every weekend as numerous buyers secure properties with the support of their families.

Many individuals receive substantial financial assistance, whether it be for purchasing their first home or when upgrading to a larger property. In some cases, entire homes are funded by family support.

This assistance from family has become more prevalent due to successive property booms that have propelled property prices at a pace outstripping wage growthover the last decade.

Any declines experienced in property prices last year were short lived.

What is your 2024 action plan?

Our top tips for staying on top of the 2024 finance roller coaster are:

TIP 1

If you are not sure whether you should ‘STAY IN’ or ‘LEAVE’ the property market as a landlord, it would be wise to seek the help of an accountant or financial planner. When you understand the costs it may help you make the right decision for your circumstances.

ACTION FOR PROPERTY INVESTORS

Talk to us to see if we can help by refinancing your investment loan into a lower interest rate. Some lenders will look at your situation favourably if you have achieved equity and have been making consistent payments. We would love to explore that option with you.

ACTION FOR THOSE WITH PERSONAL DEBT

Consider consolidating your debt to potentially free up surplus cash to repay other debt or your home loan. Please speak to us before making any hasty decisions to ensure the strategy suits your personal

TIP 2

If you are coming off a low fixed interest rate, you may experience rate shock. Start planning now for those additional home loan repayments to lessen the shock. Consider moving the future additional repayments into your offset account or savings account with a good interest rate.

Please speak to us before making any hasty decisions to ensure the strategy suits your personal circumstances.

ACTION FOR HOMEOWNERS WITH A LOW INTEREST RATE

Book in for a roll off review at least 3 months before your roll off date.

TIP 3

If you have accumulated credit cards, store cards or Buy Now Pay Later (BNPL) services and find you have too many accounts to manage, it can easily become out of control. Not only may it affect your credit score for refinancing your home loan, buying a new car or other larger item, it can add to your finance stress levels when aiming to improve your situation.

TIP 4

Start Saving

Save where you can on discretionary spending and create capacity through additional repayments to prepare for at least one more potential rate increase.

TIP 5

Help Others

Refer your family and friends to us so we can help improve their financial position.